GameStop, touting, and shorting are more like poking a bear

Not really a heist film, but a brief amusement worth another cinematic treatment of financial markets like Trading Places.

If not, here’s a quick recap: a bunch of traders — many amateurs — got together on the online discussion forum Reddit and decided they were going to pump up GameStop’s share price to get under the skin of some short-sellers. The event, unlike many others, has prompted a lot of soul searching on Wall Street. Hedge funds, in particular, seem to be going through the five stages of grief. One of the hedge funds that has felt the wrath of Redditors is Melvin Capital. The group, which tends to run a pretty aggressive short book, had bet that GameStop shares would fall. We don’t have the exact details of when this bet was made and how big it was but considering GameStop shares have gone from about $5 in August 2020 to almost $350 on Wednesday, it’s safe to say Melvin was bleeding a lot.

A David and Goliath saga is unfolding in financial markets over the stock price of struggling retail chain GameStop. On Wednesday, Goliath walked away from the battle.Two Goliaths, actually.A pair of professional investment firms that placed big bets that money-losing video game retailer GameStop’s stock will crash have essentially admitted defeat. The victor, for now at least, is a volunteer army of smaller investors who have been rallying on Reddit and elsewhere online to support GameStop’s stock and beat back the professionals.GameStop’s stock surged as high as $380 Wednesday morning, after sitting below $18 just a few weeks ago.[…]

At the same time, smaller investors gathering on social media have been exhorting each other to keep pushing the stock higher. There is no overriding reason why GameStop has attracted those smaller investors, but there is a distinct component of revenge against Wall Street in communications online.“The hedge fund owners are crying as a result of us,” one user wrote on a Reddit discussion about GameStop stock. “We have the power in this situation, not anyone else as long as we stay strong!”Almost immediately after, another user shouted in all capital letters, “BUY AND HOLD WE WILL BE VICTORIOUS.”The battle has created big losses for major Wall Street players who shorted the stock. As GameStop’s stock soared and some of the critics got out of their bets, they had to buy GameStop shares to do so. That can accelerate gains even more, creating a feedback loop. As of Tuesday, the losses had already topped $5 billion in 2021, according to S3 Partners.

Where do we go from here and who is going to step up to help us? from r/wallstreetbets

We have grown to the kind of size we only dreamed of in the time it takes to get a bad nights sleep. We've got so many comments and submissions that we can't possibly even read them all, let alone act on them as moderators. We wrote software to do most of the moderation for us but that software isn't allowed to read the Reddit new feed fast enough and submit responses, and the admins haven't given us special access despite asking for it.

We're suffering from success and our Discord was the first casualty. You know as well as I do that if you gather 250k people in one spot someone is going to say something that makes you look bad. That room was golden and the people that run it are awesome. We blocked all bad words with a bot, which should be enough, but apparently if someone can say a bad word with weird unicode icelandic characters and someone can screenshot it you don't get to hang out with your friends anymore. Discord did us dirty and I am not impressed with them destroying our community instead of stepping in with the wrench we may have needed to fix things, especially after we got over 1,000 server boosts. That is pretty unethical.

To add to this, people are co-opting our name on twitter. I won't mention their accounts, but lots of handles with “wsb” and “wallstreetbets” in them are pretending to speak for us. They're saying things that we don't agree with, driving traffic to derivative communities and shitty pixelated merch stores, and generally making it harder for us to define who we are. There's also too much political bullshit in a community that was never ever political. The only way I want to occupy Wall St is in a suit myself or rent-free in the mind of a blown up short.

— Raw Story (@RawStory) January 28, 2021

— Robert Reich (@RBReich) January 28, 2021

I wrote this in response to someone elsewhere who asked simply:

So they're betting against the company? Like, they have no faith in them? Investing like this makes one feel horrible.

Yeah. There are three ways you can short.

- You buy an option with a predetermined end date with the RIGHT to sell a stock at a certain price (depending on how much you want to pay determines the price.) If a stock is $10 and you expect it to drop to $5 in 6 months, you might buy a $9, 10 month expiry “put” (right to sell at price) option. This might cost you 50c per share.

IF you're even slightly right, ie it drops to any price lower than $8.49 before expiry you made 1c per share. You can also change your mind and sell the option (either more (profit) or less (loss) than 50c/share).

IF you're properly right, and it does drop to exactly $5 you make $3.5 per share. If it rises, or drops to any number above $8.50, you lose the price of the option (50c/share).

2) You're a big player. You call your buddies at Pension Fund X42 and say “Hey can I borrow those shares you have for x% interest and return them to you later?” A set timeframe may be set. I don't know for sure, but probably. Anyhow, Pension Fund X42 says “ok” because they aren't looking to sell them, so might as well make some interest on lending them.

So you borrow them, and immediately sell them. You pay your daily interest to the pension fund, and you wait. When the price drops, and you decide that you've made enough, you buy them back and return them. You keep the difference in prices whatever that may be, minus the interest.

If you're wrong… You're still obliged to return the shares to Pension Fund X42. So at some point you have to decide to eat a loss and buy the shares back.

3) You're a big player and you are ok with a bit of lawbreaking, you Naked Short Sell. This is great because it's cheaper! No interest payments!

Here, you simply sell shares you don't have, and buy the imaginary shares you just created back later so that the number of shares on issue doesn't get too far out of whack and you don't get investigated. Any gap between your sell price and buy price is profit or loss depending on which way it goes.

What's happened right now is mostly a combination of 2 and 3. I'm sure there is a bit of 1, but 1 only causes predictable losses (Like the cost of playing a hand at a casino. You only lose the amount you bet if the cards don't go your way.)

So the risk with 2 and 3 is that because you're obliged to buy back the shares at some point, if they go up, when you have to quit, you have to pay the current market price and your actions can make the price go up even more.

Now you're in a short squeeze. You are obliged to buy but the price keeps going up every time you do. It's entirely possible that others see the price going up and buy, so you're now competing to buy a limited number of shares with everyone else. So the price goes higher. Your losses are potentially infinite.

What's slightly different between this particular short squeeze and all the others is:

- The dumb fucks naked short sold AT LEAST 40% more shares than ever existed. They're obliged to buy back more shares than is possible. The only way out of that self-made trap is a complicated mess of desperately buying, returning, rebuying from the people you borrowed them from, and returning them with losses at every step. Imagine if I sold you 10 cars, but only delivered 6. You're standing there with your wtf face and I say “Hey! how much would you sell those 4 cars for?” You can name your price at this point. I pay it. Then I “finish” my “10 car delivery.”

2) Retail traders are acting as one single semi-coordinated hive, loosely behaving similarly to what would in prior short squeezes, be a competitor hedge fund. They own a lot of the shares the hedge funds (HFs) NEED to buy – but they're not selling. They're actively cheering for the HFs bankruptcy while watching the price of the stock they hold skyrocket. Only other HF billionaires are allowed to do that and get away with it.

2a) HFs can be negotiated with. If you're really, really getting bent over and fucked, and you grovel enough, you can usually cut a deal where they stop trying to fuck you. If they won't talk to you, they'll often talk to your bank/broker/some other bigger player that can convince them that your bankruptcy will also cause significant losses or bankruptcy of another party they're not trying to fuck and they might like to have as friends one day. “You quit this, and we'll owe you one.” It's always good to have favours to call..

2b) The self proclaimed retards on WSB can't be negotiated with. They don't need favours. They don't care if you go bankrupt or there's collateral damage. They don't give a fuck about any of them. For the most part they only hold a few hundred shares each max – and also for the most part, they're playing with their own money that they can actually afford to lose even if it hurts for a year or two.

How do you negotiate with, or swat a million wasps stinging you? You can't.

— Emmanuel Elmajian (@elmajian) January 28, 2021

— So-called Dave (@DavidWetherell) January 28, 2021

— Arindrajit Dube (@arindube) January 28, 2021

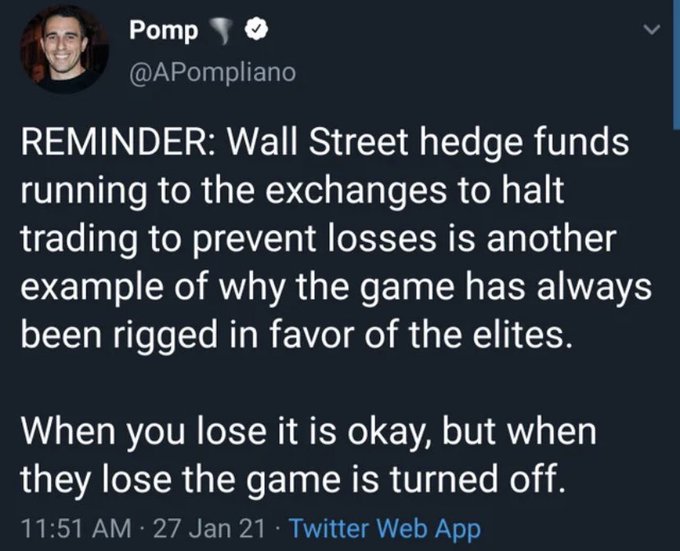

— Matt Stoller (@matthewstoller) January 27, 2021

Ugly stuff.

— Avalon Penrose (@avalonpenrose) January 27, 2021

<

p class=”is-empty-p”>